First home buyers seem to be a popular topic of discussion in Australia. They’re either getting a lot of government incentives and grants on the one hand. Or, they are finding it tough to get into the

property market due to rising house prices on the other.

Over the years, I’ve been invited to talk at various conferences. Just recently, at the end of one of my presentations, a young, freshfaced lad raised his hand and asked me: “I’m a first home buyer. I plan to live in my property for a year. Then I will move out and turn that property into a rental. Can I still claim depreciation when I move out?”

Each state has its own first home buyer’s incentive schemes (or first home owner grants) and they are continually changing. But the simple answer is yes. First home buyers can still claim depreciation once they move out. This seems to be a growing trend. People are buying properties for the first time, living in them for a certain period of time, and then renting them out.

Having someone else pay your mortgage could be a good strategy for some people, particularly if they can only afford to buy in a certain area (say the outer suburbs) but they would prefer to live elsewhere, for a while at least. It’s like having their cake and eating it too. But let’s have a closer look at the implications of this.

FACT: You must occupy the home as your principal place of residence for a continuous period of at least six months, commencing within one year of the completion of the transaction to which the application for the first home owner grant relates.

THE (TAX) LAW

The Income Tax Assessment Act 1997 determines what types of properties qualify for the building allowance deduction (for a full explanation of building allowance deductions please see the

Washington Brown ebook, How to Calculate Depreciation and What to Claim For, available from www.washingtonbrown.com.au).

According to Section 43-90 “Residential Accommodation” is classified as a type of property that can attract building depreciation allowances, providing that was its intended use (as residential

accommodation) at the time of completion. Luckily for first home buyers, this requirement is satisfied even if the accommodation was intended to be used for private purposes or to be owner-occupied after its completion. The important part of the Act relates to how the property is used in the “current year of use”. Put simply, it’s OK to live in the property for a year or so, then move

out and claim depreciation. But before all the first home buyers get excited, let’s drill into the nitty-gritty of this and the potential savings or benefits.

First home buyer grants favour brand-new property

First of all, let me point out that the first home buyer grant currently

favours buyers who purchase brand-new property. By favouring new property, the government is hoping to stimulate building activity – which is generally the first industry to lead the way out of a recession.

The building industry also stimulates other industries such as retail (people need to buy new TVs, lounges and other items when they move into a new home) and this has a knock-on effect on the wider economy.

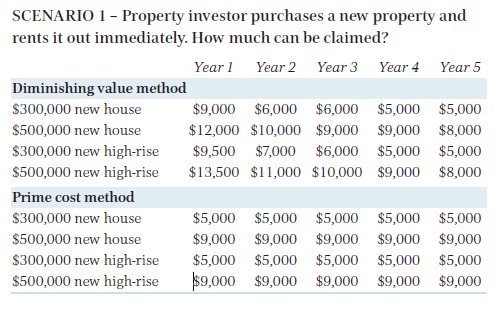

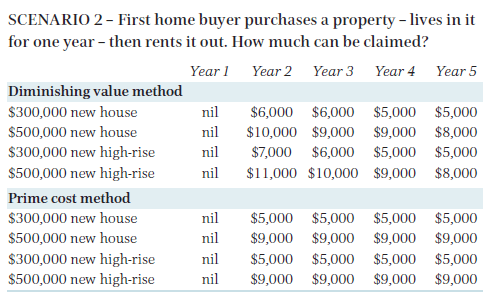

For this reason, the following comparison tables below look at new properties. I am also showing you the difference between using the diminishing value method, which accelerates the allowances you can claim and the prime cost method, which evenly spreads out the allowances you can claim. The method of calculation you use will depend, in large part, on how long you intend to use the property as an investment.

New vs old property being rented and depreciation allowance

There are two things that become obvious from these examples:

1. The amount a first home buyer can claim is only affected while they live in the property. This makes sense because while you live in the property, it is still depreciating, so you just can’t claim

the depreciation as a tax deduction.

2. If you did buy a property as a first home owner and lived in it for a year, using the diminishing value method would still be more beneficial in the short term. Again, it is best to check with a

qualified quantity surveyor to ensure you maximise your tax savings in your own particular circumstances.

While I don’t intend to advise first home buyers (or any other property investor) whether now is a good time to enter the market or not. I’d like to say that if you do turn your castle into a rental, don’t ignore the depreciation benefits you’re entitled to. As Kerry Packer once famously said, “Pay your tax, but don’t tip them. They are not doing that good a job!”