Did you know?

Did you know that lower-priced property often has a higher depreciation ratio in relation to the purchase price?

During one of my recent media interviews, a journalist asked me to explain my comments on this issue. Most of us know that higher-priced property tends to rent on a yield far less than lower-priced property, don’t we?

But why is this? Why doesn’t a luxury house in Vaucluse in Sydney or Toorak in Melbourne, for example, rent on the same yield as houses in less affluent suburbs? Or even when you have two

properties in the same suburb, why is the yield of a one-bedroom flat greater (as a percentage of purchase price) than that of a four bedroom property?

There are three main reasons for this:

1. Wet areas

Known in the trade as ‘wet areas’ – kitchens, bathroom and laundries – are more expensive to build, compared to bedrooms, on a per square metre basis. And the greater the construction cost, the

more you can depreciate.

So a lower-priced property – for example, a one-bedroom apartment – still has a kitchen and a bathroom and as we increase the number of bedrooms (which are cheaper to build), and increase the price we pay for larger dwellings, the construction cost – as a ratio – decreases.

2. White goods

White goods in wet areas are also depreciable at a higher rate. Wet areas have items such as ovens, dishwashers, range hoods and a clothes-dryer included within them. These items depreciate at a quicker rate than brickwork and concrete. So, as you add more bedrooms or other rooms to the mix, you reduce the effective life of these highly depreciable items. Remember, it is better to have an item depreciating at 20% per annum as opposed to it depreciating at the building allowance rate of 2.5% per annum because you get your deductions faster.

3. Land value

As the price of the land increases, the house or construction cost decreases (as a percentage). For example, we see many house and land packages where the ratio of the construction cost to the purchase price is roughly 50/50. This means if the final purchase price was $500,000, the land portion is $250,000 while the building cost is the remaining $250,000. When you start moving up the ladder to the luxury end of the market there is only so much building you can physically put on the land. For instance, there was a recent landmark sale in Bondi, Sydney, where the developer paid approximately $4 million for a 100m2 block of land. The most the developer will be able to build on this property is a maximum of 300m2 internally (three-storeys).

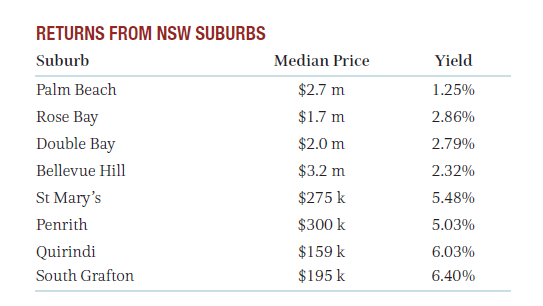

Even if the developer uses gold-plated taps, I doubt they would physically be able to spend $2 million on the construction of this property, which is far less than the 50/50 ratio that can be achieved at the lower end. The table below better illustrates this theory. These are all suburbs of New South Wales. You would get similar returns from comparable suburbs in other states.

Confirming validity-

I’ve talked to other industry players and peers, and they all confirmed the validity of this trend. So in summary, here’s my take on why the high-end property has a lower yield:

- Supply and demand is certainly a factor. There will always be less demand for higher-end property.

- People are less inclined to pay rent for land. So, it makes sense that properties with a higher land value, as a factor of the overall property value, will, as a ratio, rent for less.

The capital gains tax-free status that we currently have on property that is your principal place of residence is a very effective wealth creation strategy which leads to people upgrading as opposed to jumping back into the rental market.

- Our national obsession with home-ownership means we are often only willing to pay so much rent before we switch to a mortgage. With a home-ownership rate of around 70%, we’re up there with Canada, the UK and New Zealand as having the highest homeowner concentration in the world.

- A large proportion of those wanting to live in a high-end property are from the ‘family’ segment of the market. The thought of moving every two years may drive that market to look for more stability.