Washington Brown specialises in Quantity Surveying and Tax Depreciation Schedules for Perth and Western Australia regional areas.

With Western Australia being such a large state – we need to investigate first whether your rental property in, say Geraldton or Kalgoorlie, needs an inspection.

Our Perth quantity surveyors, professional members of the Australian Institute of Quantity Surveyors, specialize in maximizing cost savings on your investment property.

How will a Perth property tax depreciation report help me?

As a property investor, you are entitled to claim the wear and tear of an investment property against your taxable income.

Just like a business can claim tax depreciation deductions on a computer or desk, you can claim the depreciation on your investment property.

To maximise your savings on your Perth investment property is get a Perth Depreciation Report quote.

Don't Miss Out- Get a Free Depreciation Quote Today

What does a Perth depreciation schedule look like?

A tax depreciation schedule example is simply a booklet or pdf breaking down the amount you can claim.

You can claim two types of depreciation.

Firstly you can claim the capital works allowance, and secondly, you can claim the depreciation on the Plant & Equipment assets.

Remember, you have to have the property as an investment property to claim the depreciation.

You can not live in the property and claim property depreciation.

Most people receive their depreciation via email these days, so it looks more like a pdf than a booklet.

What is included within the Capital Works allowance?

The capital works deduction refers to the structure of the building.

You can claim this structure over 40 years from when the property was built, also known as the Division 43 depreciation.

Let’s say you buy a 10-year-old property in Perth; you can now claim the original building cost for the next 30 years at 2.5% per annum.

SO if your property cost $100,000 to build ten years ago, you would be able to claim $2,500 for the next 30 years if you acquire that property today.

What is included within the Plant & Equipment?

Plant and Equipment items refer to those included within a building that are more easily removable.

This is why they have a shorter effective life.

This suggests it isn’t anticipated to have a lengthy lifespan.

Plant & Equipment items include carpets, Ovens, Blinds & Dishwashers etc.

Step by Step Guide to work out how much you can claim with a Perth tax depreciation report.

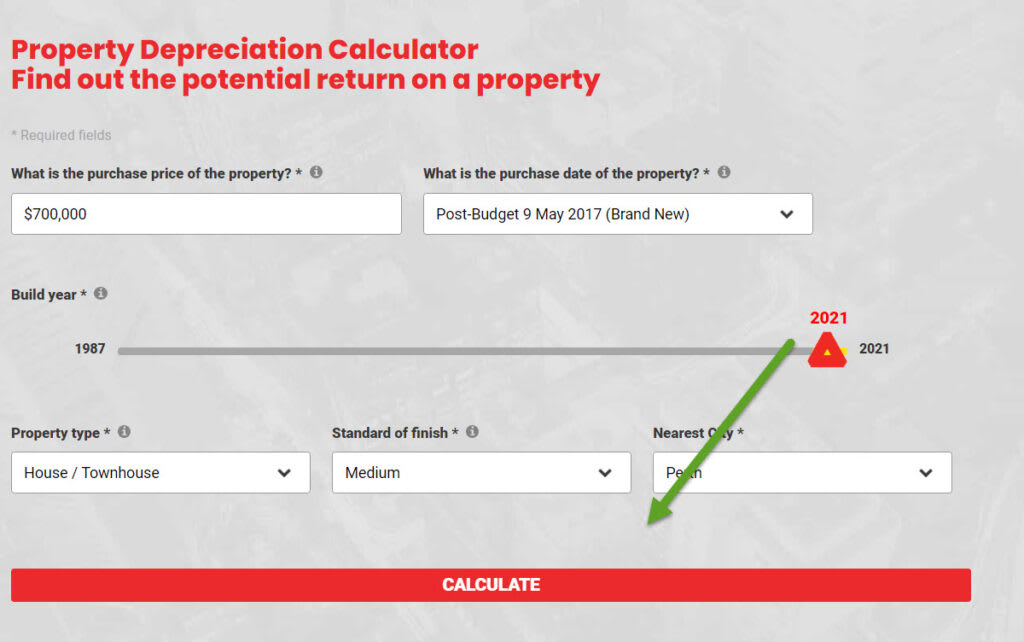

1 – Use our Free Tax Depreciation Calculator

Property Depreciation Calculator

Find out the potential return on a property

2 – Enter the details of your Perth Investment Property as shown below

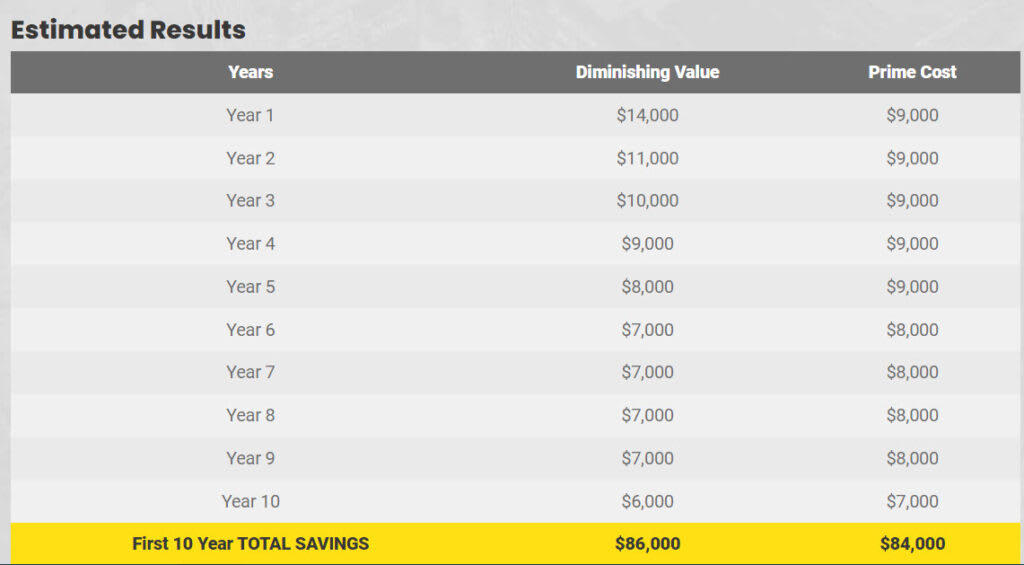

3 – Press calculate and see the results below.

Tax Depreciation Reports Perth

We are experts in Property Tax deductions for all property types – residential and commercial property.

We guarantee to save twice our fee in the first year, or your tax depreciation report will be FREE. Try our exclusive tax depreciation calculator and determine how much money you could be saving on your Perth investment property!

Maximise the tax return savings on your investment property. Get a depreciation schedule quote now

or Call us on (08) 6270 6386