Why every property investor in Darwin needs a Depreciation Schedule now

For an obligation free quote – Quote me now

To discuss your investment property call us on 08 8911 0410

Tax Depreciation advice, Depreciation Schedules Darwin, Investment property tax entitlements

To optimize your tax savings on your investment property in Darwin, you’ve landed in the right spot.We service Darwin and surrounding regions, including Stuart Park, Casuarina, Woolner, Humpty Doo, Fannie Bay, Palmerston and Nightcliff.

Washington Brown are Darwin Quantity Surveyors who have provided tax depreciation services and advice to property investors for over 30 years. Our team are experts in tax depreciation, ATO regulations, tax law, and qualified quantity surveyors. We are also registered tax agents with the Tax Practitioners Board.

We have experience in all property types – residential, mixed-use, commercial and industrial properties. For expert advice on how you can save in tax depreciation while still following ATO regulations request a quick quote.

Get Your Free Depreciation Schedule Quote Today!

About Rental Tax Depreciation Reports

A professionally prepared tax depreciation schedule can save you thousands in tax savings. As an investment property owner, you are legally entitled to claim the depreciation of your investment property against your taxable income.

Some vital property depreciation facts:

- All properties, irrespective of age, qualify for depreciation. Whether you own a new or second-hand property, you will be able to claim some depreciation allowance

- If you have not been claiming or maximising your entitlements, you can backdate your tax return

How much will I save by organising a Darwin Depreciation report?

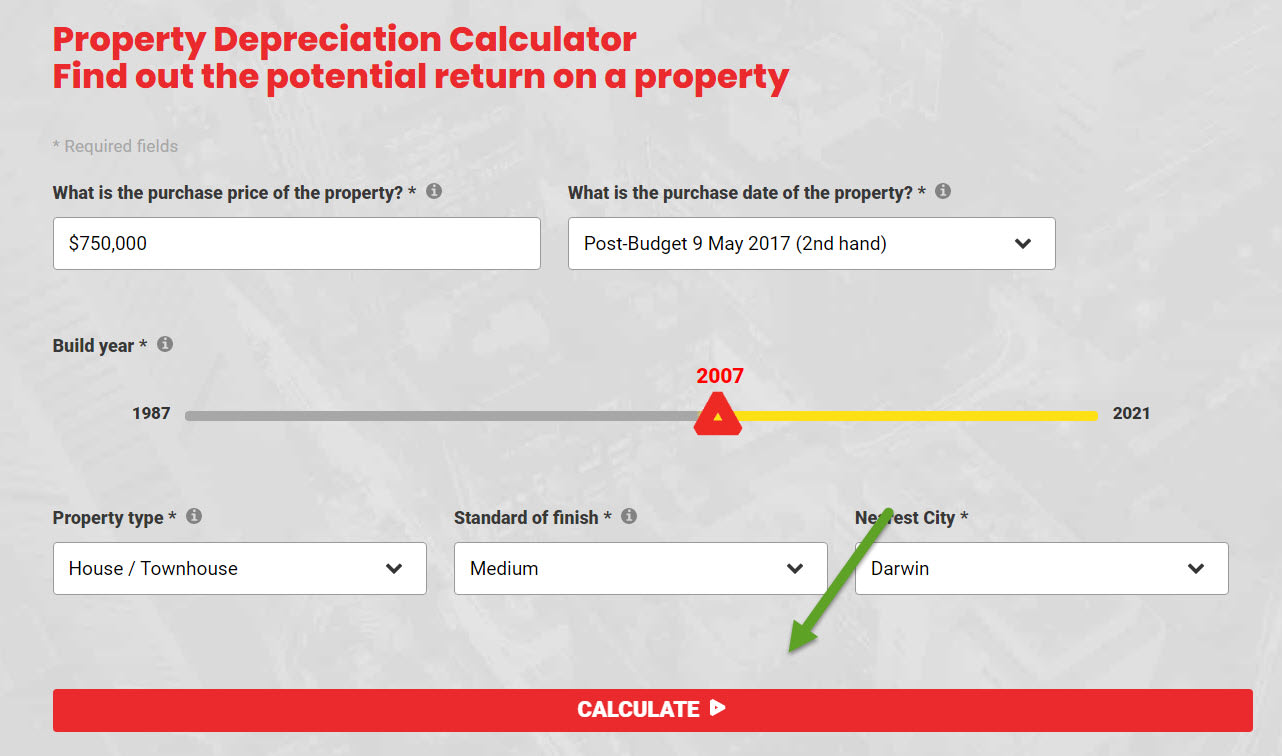

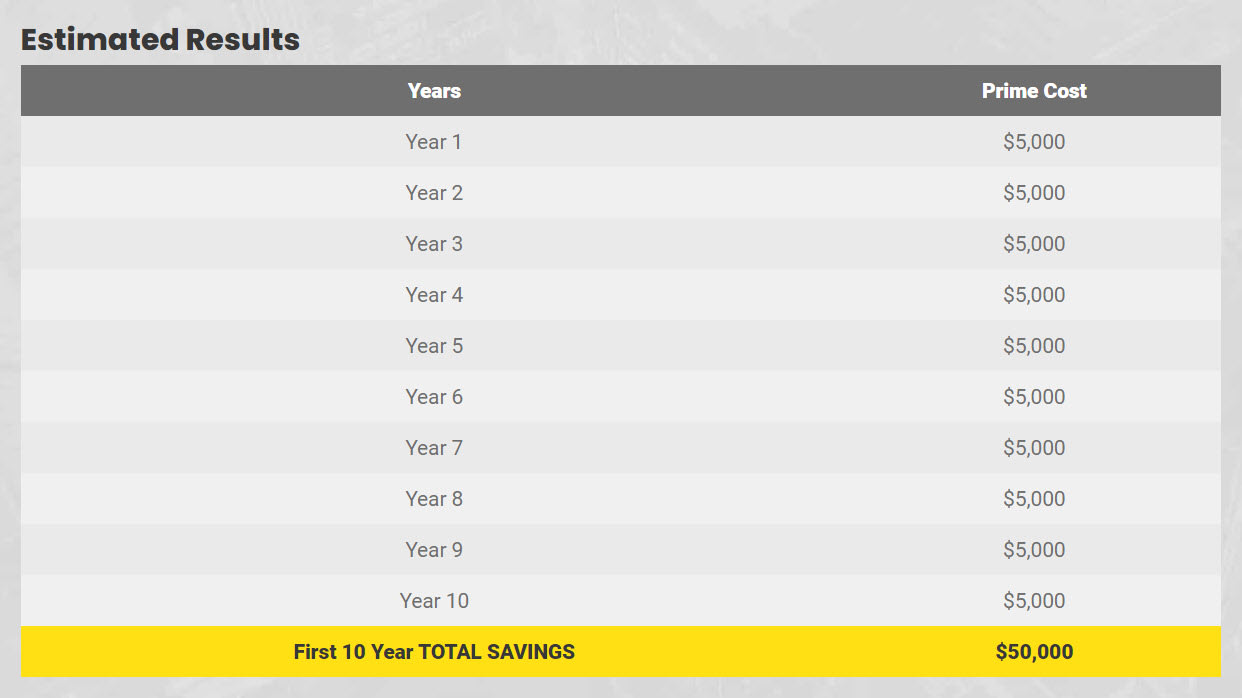

Try our exclusive online tax depreciation calculator on this page. You’ll get an estimate of your potential tax savings in a few short clicks.

Use the Washington Brown tax depreciation schedule calculator to view an estimate on your potential tax savings.

Property Depreciation Calculator

Find out the potential return on a property

Step 1 – Firstly, input the area required, property type, purchase price and when you purchased the property.

Step 2 – Press calculate to determine the depreciation value of a house & how much you can save with your Darwin Depreciation Schedule.

Why choose Washington Brown

- You’ll get excellent customer service.

- Your report will be free if we don’t save you twice our fee in the first year.

- We assess over 15,000 properties per year for depreciation allowances.

- We stand by the accuracy of our depreciation reports

- Our team of tax depreciation experts are members of the Australian Institute of Quantity Surveyors

For an obligation free quote – Quote me now

To discuss your investment property call us on 08 8911 0410

Finally, we have been in business for over 40 years and plan to be in business for another 40 at least.