Why every property investor in Melbourne needs a depreciation schedule.

Simple. A depreciation schedule or report will save you money as a property investor.

For over 40 years, Washington Brown Melbourne Quantity Surveyors have prepared Melbourne residential and commercial depreciation schedules in Melbourne and the surrounding regions – Ballarat, Dandenong, Geelong, Bendigo, Albury, Frankston, Melton, Werribee, Pakenham, Tarneit, Moe, Craigieburn.

How will a depreciation schedule help me as a property investor?

You can claim the wear and tear of an investment property against your taxable income. If the property is brand new, you can claim both the Plant & Equipment (Ovens, Dishwashers etc.) together with the Capital Works deductions (Brickwork, concrete, i.e. the structure of the building).

Will you need to inspect my property to get the maximum depreciation?

With the recent changes to the depreciation laws , there are three reasons why not every property will need an inspection in order to claim the maximum depreciation.

This video explains the reasons why.

How much does a depreciation report cost?

Fees can vary subject to whether your property needs an inspection or not. The recent depreciation law changes have meant that not every residential property needs an inspection.

The type and size of the property can also influence how much your depreciation report will cost.

Fill in your details to get a depreciation schedule quote:

Get a Quick Depreciation Schedule Quote Below

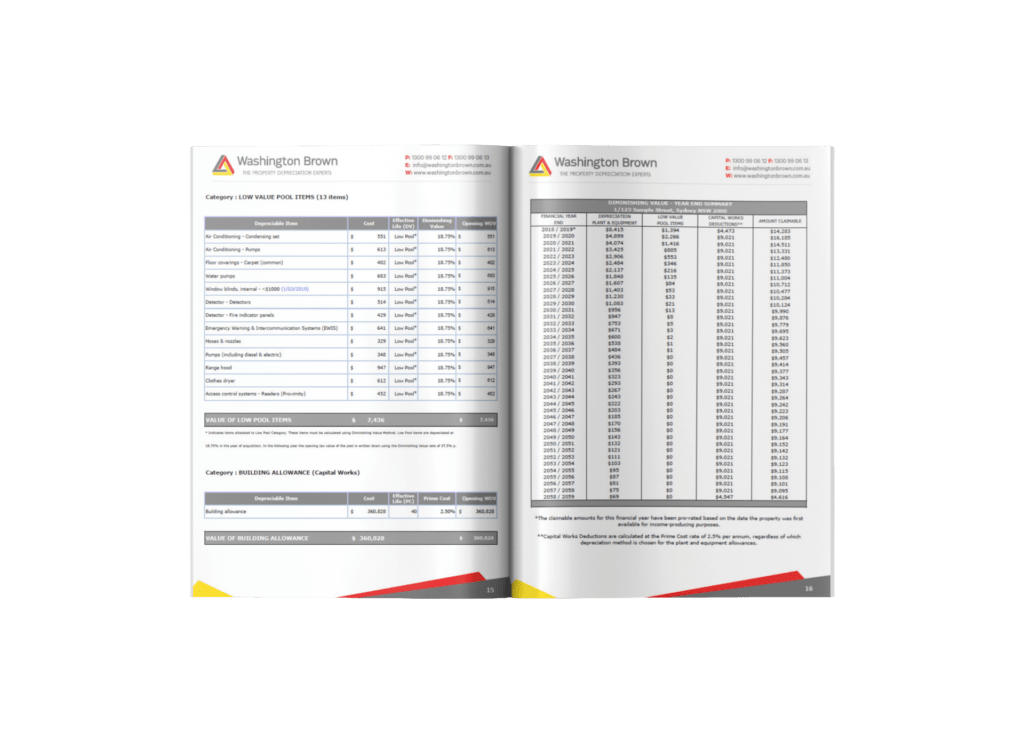

What does a tax depreciation schedules look like?

A depreciation schedule should provide two ways you can claim depreciation. Firstly it should show the prime cost method of depreciation and the diminishing value method.

Why choose Washington Brown to prepare your depreciation schedule?

- Our Google reviews have an average rating of 4.9

- Independently chosen as Quantity Surveyor of the year

- Members of the AIQS and registered with the Tax Practitioners Board

- Over the last 40 years, the Australian Taxation Office has not disallowed one report.

- We have been in business for over 40 years and plan to make it 100 years!

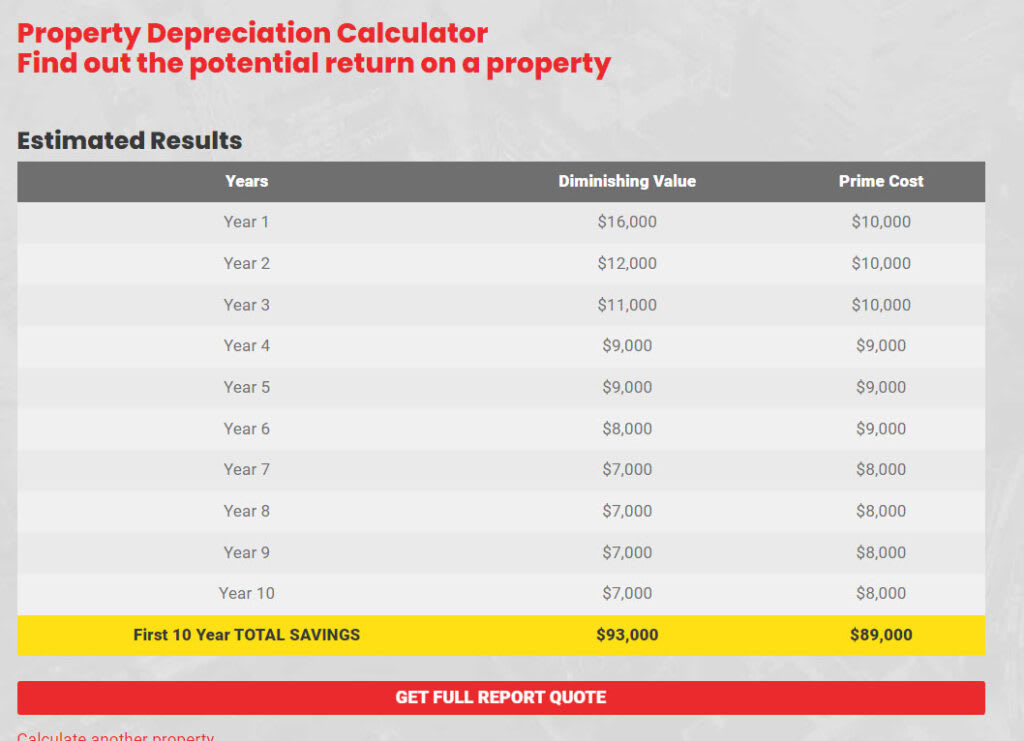

How much can I save if I order a depreciation report?

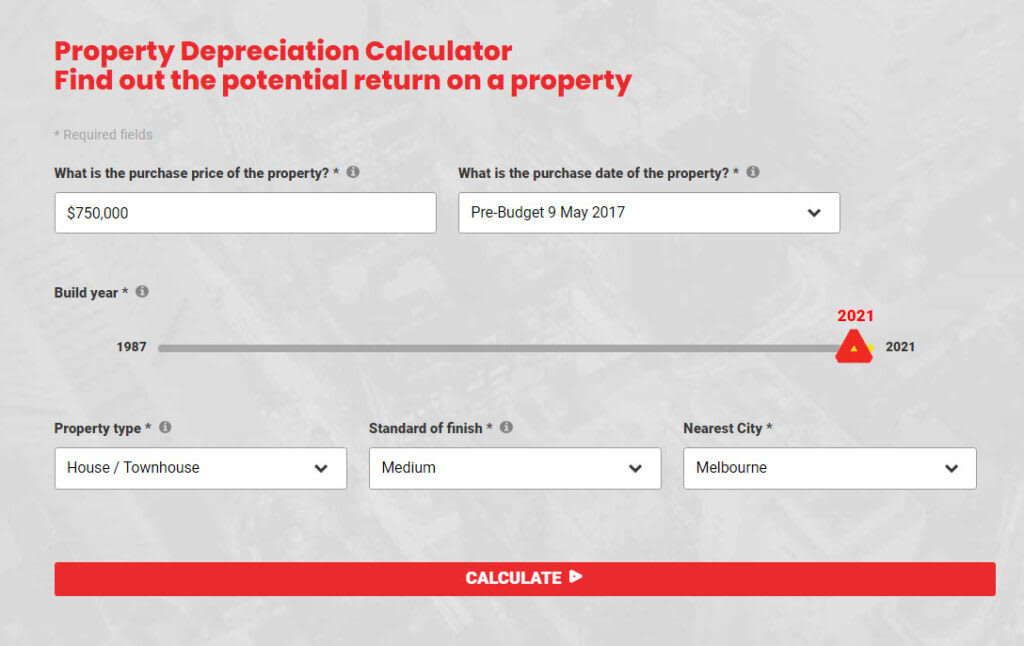

The best way to determine how much you can claim on your investment property is to use the Melbourne Property Depreciation Calculator.

Property Depreciation Calculator

Find out the potential return on a property

Step One – Enter the details of your investment property, including

- How old the rental property is

- The purchase price

- The nearest city (Melbourne)

- The standard of finish

- When you bought it

Step 2 – See how much your depreciation schedule estimate will enable you to claim.

Can my accountant prepare my depreciation report?

The Australian Taxation Office has ruled that Quantity Surveyors have the appropriate skillset to prepare depreciation schedules – not accountants.

Do you prepare depreciation schedules on commercial properties?

Washington Brown has been preparing depreciation on a range of properties for many years. We have prepared reports for Large shopping centres and industrial complexes down to your suburban office suite.

The good news about commercial or non-residential property is that you can still claim the Plant & Equipment even if the property is second-hand, unlike residential Melbourne deports.

So whether you are the landlord or the tenant, you still can benefit from a depreciation report because if you are a tenant, you can claim the depreciation on the fit-out. If you are the landlord, you can claim the depreciation on the building itself in your tax return.

Washington Brown are members of the Australian Institute of Quantity Surveyors and the Tax Practitioners Board.

How long will it take for my depreciation schedule to be prepared?

The main factors in determining how long a depreciation report will take to prepare comes down to whether the property needs an inspection or not and how easy gaining access to the property is.

If your property does not need an inspection, the report will be with you quickly due to the law changes.

On average, the reports can take between 3-10 days for you to receive.

We guarantee to save twice our fee in the first full financial year, or your tax depreciation report will be FREE. Try our exclusive Melbourne tax depreciation calculator and find out how much money you could be saving!

Maximise the tax savings on your investment property. Get a quote now