In Australia, we property investors are fortunate. Why? We can claim the cost of construction for investment property as a tax deduction.

This doesn’t happen worldwide, so we should make the most of it, as property investors can.

Even the recent depreciation law changes did not change the fact that we offset our taxable income by claiming the wear and tear of our investment property against our taxable income.

What Is The Capital Works Deduction Rental Property?

The capital works allowance, or the building allowance as it is more commonly called, refers to the construction costs of the building itself, including items such as concrete and brickwork.

It is referred to as Division 43 Capital Allowances in the Income Tax Assessment Act.

How much can I claim in depreciation?

Use our free tax depreciation calculator to work out how much you can claim:

Property Depreciation Calculator

Find out the potential return on a property

How much does a depreciation schedule cost?

Get a quick quote here and start saving today.

Get a Quick Quote Now

Capital Works Allowance Rental Property

Division 43 Capital Works deductions are income tax deductions. These allowances can claim for building construction costs or the cost of altering or improving a property.

Regarding residential properties, the general deductions are spread over 40 years. When purchasing a property, remember that the capital works deductions cannot exceed the construction expenditure.

Also, no depreciation deductions are available until the construction has been completed if you are waiting on a new build to claim your deductions.

Determining deductions based on actual construction expenditure applies to capital works. Some examples are as follows;

- A building or an extension. E.g., adding a garage or a room

- Making structural improvements to the property

- Making alterations to the property

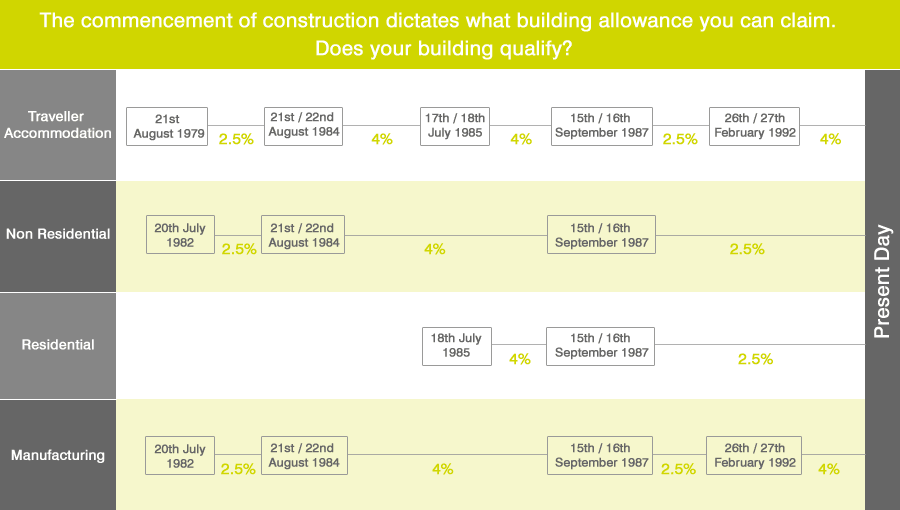

- You can claim several deductions depending on the construction type and the property’s commencement date.

Learn more about the building allowance by watching this video

What Can be Claimed As A Capital Work Allowance?

Construction expenditure refers to the actual cost of constructing the building or extension. Deductions are possible on the expenses incurred in constructing a building based on the original construction cost.

Items that can be included within the building cost include:

- Design costs and professional fees

- Council costs and associated authority fees

- The structural costs of the building, items like concrete, brickwork, tiling and the like.

What can’t be claimed as a Rental Property Capital Works Deduction?

Some of these costs that are not included are listed below;

- The cost of the land on which the property is built on

- The costs of landscaping

- Expenditure on clearing the land before the construction commencement

- Depreciation of the Plant and Equipment depreciating assets.

What is the rate of the deduction?

The capital works deduction allowance rate depends on several factors:

- The type of property in question. For instance, residential property has a different rate than hotel apartments.

- When the property was built significantly influenced the rate of the capital works allowance.

These rates have been determined by the Australian Taxation Office – Capital Works Rate.

When does construction have to commenced?

For residential, office and most industrial building construction needs to have commenced after 15 September 1987 as can be seen below.

We will then determine the actual construction cost backdated to that point in time.

Do I have to make a cost base adjustment for capital works deductions claimed?

Cost base adjustments refer to determining a rental property’s capital gain or loss.

The cost base and reduced cost base of the property may need to be reduced to the extent that it includes construction expenditure which you, as an investor, can claim in capital works deductions.

If you claim the capital works deduction, you need to factor the amount you have asserted into the equation when you sell the property.

But, using the principle that a dollar claimed today is better than a dollar later – it’s better to claim the deduction.

The other factor to consider is that if you hold your property for more than one year, your Capital Gains Tax payable is halved.

So, as property investors, it’s better to claim the capital works allowance than not.

How do you calculate how much I can claim?

To calculate how much housing depreciation you can claim in capital works deduction, you need to understand the principle of the deduction applicable.

As you can see from the above graph, the 15th of September 1987 is an important date for residential property, as that is the date the construction has to commence after.

The capital works deduction rate is 2.5% of the original construction cost.

So, let’s say you build a property today for $350K; you first need to deduct the plant, equipment, and landscaping out of the equation.

That will leave $300k in capital works deductions available.

You can claim the $300k at a rate of 2.5% per annum over forty years – that equates to $7,500 per annum if I continue to hold that property for forty years.

Now, let’s say in 20 years, I buy that property as an investment. I will still only be able to claim $7,500 per annum, but I will only be able to do that for another 20 years in your tax returns.

Using the Capital Works Deduction Calculator, you can estimate your capital works deductions allowance.

Why use Washington Brown to calculate my capital works deductions?

- Our Google Reviews are outstanding

- Independently voted Quantity Surveyor of the Year

- Have prepared over 225,000 reports, and the Australian Taxation Office has disallowed not one report.

- Member firm of the Australian Institute of Quantity Surveyors

- Registered with the Tax Practitioners Board

- Have been in business for over 40 years – (See video below)

Get a Capital Works Deduction Quote if you want to start claiming capital works deductions for your investment property.