See How Paul Reduced His Taxable Income By Over $16,000

Client Name and Unit Number have been altered for privacy.

Having recently settled on an off-the-plan apartment in Clayton, Victoria, Paul’s accountant suggested he contact Washington Brown to maximise his tax deductions.

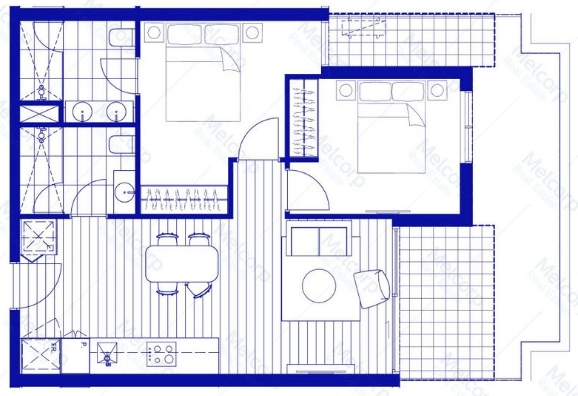

The 74sqm, 2 bedroom, 2 bathroom apartment was purchased for $559,000 in 2020.

As Paul was the first owner and had never occupied the property himself, he was eligible to claim deductions on both the structural elements (Building Write Off Allowance / DIV 43) and the fixtures/fittings (Plant & Equipment / DIV 40).

Washington Brown was able to achieve the below, ATO-compliant deductions for Paul. As he settled in August, the first years’ figures show the maximum deductions available based on 11 months’ ownership in that financial year.

By forwarding the depreciation schedule files to his accountant, Paul benefited from a first year tax depreciation deduction of almost $17,000. The schedule/report detailed over $300,000 worth of deductions over the full 40-year period.

Note: Please scroll across on mobile to view full deductions.

| Financial Year | Plant & Equipment | Low Value Pool Assets | Capital Works Deductions | Amount Claimable |

|---|---|---|---|---|

| 2020 / 2021 | $9,674 | $1,109 | $6,113 | $16,895 |

| 2021 / 2022 | $4,095 | $1,802 | $6,680 | $12,577 |

| 2022 / 2023 | $3,322 | $1,126 | $6,680 | $11,128 |

| 2023 / 2024 | $2,731 | $704 | $6,680 | $10,115 |

| 2024 / 2025 | $2,271 | $440 | $6,680 | $9,391 |

To view the full depreciation schedule, including an individual asset break up and Prime Cost deductions, you can download a copy here.

Or to see how much you could potentially claim on your own property, try our free Depreciation Calculator below.

Property Depreciation Calculator

Find out the potential return on a property

Want to order a depreciation schedule? Get a quote here.