If you own your own business, are you currently leasing commercial space but considering buying your own premises? Or are you considering investing in your next property but can’t decide between a commercial or residential investment?

Commercial property has fared far worse than residential property since Covid and beyond. The number of transactions has plummeted. And those transactions that have occurred are well below the value of two to three years ago. So now might be the right time to go from tenant to master of your domain and buy that building from your landlord.

If this idea appeals to you, you’ll need to understand the tax depreciation allowances available to you as an investor of commercial property. There are some significant differences in the allowances you can claim on residential property. Being aware of these may mean substantial savings for you.

Let’s have a look at these differences.

DIFFERENCE # 1: Owner occupiers can claim depreciation

With commercial property, you can occupy the property you have purchased and still claim depreciation. If you are buying a residential property to live in, you cannot claim depreciation on that property as it is not income-producing. But with commercial property, you can spend as much time in the office as you like, and the ATO won’t consider the office your principal place of residence!

Many people buy commercial property in their name or through their self-managed super fund and then lease the property back to the business they own. This enables the individual taxpayer or super fund to claim the depreciation allowances, which can be substantial.

DIFFERENCE # 2: Allowances qualify for older buildings

The building allowance compensates investors for the decline in the value of your property’s bricks and concrete components. The date when construction of your building commenced usually determines whether you can claim the depreciation of the structure against your taxable income. With residential property, construction must have started after the 18th of July 1985 to be eligible for depreciation allowances. With commercial property investments, older buildings qualify for the building allowance.

Commercial property can be three years older and still qualify.

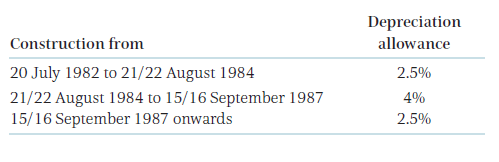

To qualify, commercial property construction needs to have commenced after the 20th of July 1982. On nonresidential properties, the allowance is as follows:

DIFFERENCE # 3: Items and rates differ for commercial and resident property

The items you can claim and at what rate also differ between commercial and residential properties. Each year the Tax Commissioner publishes a list of what items you can and can’t claim. Residential property investors have their definitive list detailing the items of plant and equipment that can be claimed. Commercial property owners don’t have their special list, but some differences are pointed out in Table B of the Effective Life Schedule published by the ATO.

For instance, carpet in residential property can be claimed over ten years. But in commercial property, carpet is claimed for over eight years. This is because the ATO recognises that carpets will wear out faster in commercial property due to the higher volume of people walking on them.

Some other differences include blinds. According to the ATO, blinds last longer in commercial buildings. They are to be claimed over 20 years as opposed to residential property blinds, where they are claimed over ten years.

The latest Effective Life Schedule highlights industry-specific items. For instance, if your business is a restaurant, the ATO has an entirely separate category of items you can claim. There is a very detailed list of businesses that are separated right down to pig farming! If this interests you, you should visit the ATO website, www.ato.gov.au.

Let’s do some Number Crunching

So how does commercial property stack up against residential concerning depreciation?

There are some similarities between the two, for instance:

- The higher quality of the commercial property, the higher the depreciation – this is the same in residential property.

- The taller the building is in the commercial property, the higher the depreciation allowance – the same happens with residential property. This is because taller buildings have more services, such as lifts and fire services.

- Like a residential property, the newer the building, the higher the depreciation allowance.

So using the Property Tax Depreciation Calculator*, I have exported the following data:

| Price & Type | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| $800k New Commercial Suite | $15000 | $12000 | $9000 |

| $800k High-rise Residential | $18000 | $13000 | $10000 |

| $800k Low-Rise Unit | $14000 | $12000 | $9000 |

| $800k Industrial Suite | $9000 | $8000 | $7000 |

The results show that a commercial suite depreciation is somewhere between a high-rise and low-rise residential apartment.

You will also get more depreciation on a commercial suite than a factory unit.

This is because a factory unit does not have as much plant and equipment and is nearly all made up of concrete and steel.

In summary

If you are the tenant in commercial property and think now might be a good time to become the owner/occupier – don’t forget to claim those tax depreciation allowances available to you as a landlord.

If the original construction costs are unknown, instruct a qualified Quantity Surveyor to estimate those costs.

*Results from the Washington Brown Commercial Property Depreciation Calculator may vary from time to time as the calculator is dynamic and changes with more properties inputted.