What is a Property Tax Depreciation Schedule?

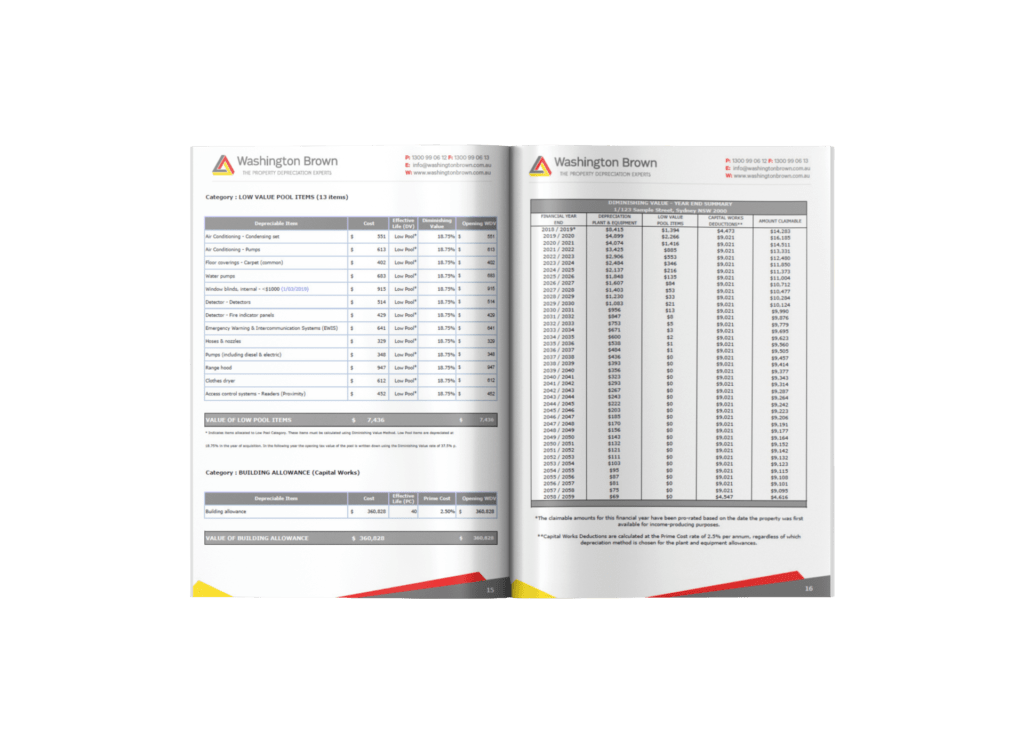

Depreciation itself means that the values of particular assets decrease over time because of constant usage (wear and tear). Tax depreciation schedules are documents that list all of these assets and their respective decline in value. Property investors can then use this data to claim their annual income tax returns. An income tax depreciation report helps you reduce your taxable income and claim tax deductions on your investment property.

Australian tax depreciation schedules calculate by determining the building’s original construction cost and the assets’ plant and equipment costs.

A residential tax depreciation schedule, for example, might show that the original construction cost for a house was $250,000. Two categories separate the depreciation deductions:

- Division 43: Capital Works/Building Allowance

- Division 40: Plant and Equipment

Let’s say the Capital Works Allowance component makes up $220,000 of the $250,000 total cost. This includes structural elements, such as roofing, shower screens or windows. Investors are eligible to claim this cost at 2.5% per annum.

The plant and equipment, totaling the remaining $30,000, cover items like cooktops, exhaust fans, and window curtains. These depreciable assets typically depreciate faster based on their effective lives.

How much does a depreciation schedule cost?

Depreciation schedules for residential properties vary depending the type of property, location and whether an inspection is necessary.

The best way to work out how much a depreciation schedules costs is to get a quick quote below:

Get a Free Depreciation Quote Now

How much can I save by getting a depreciation schedule on my property:

For an accurate estimate of your investment property’s depreciation, try our free depreciation schedule calculator:

Property Depreciation Calculator

Find out the potential return on a property

Why would I use Washington Brown?

Well our reviews are a testament to our success – you can review our live Trust Pilot reviews here:

Why are tax depreciation schedules required?

Legally, you require a depreciation report for rental properties to decrease the taxable income on your investment property using depreciation. Furthermore, you would wish to engage a qualified quantity surveying organisation to do your tax depreciation.

Washington Brown, established in 1978, is among the longest-standing and highly respected quantity surveying firms in Australia.

Furthermore, when you arrange a tax depreciation consultation with us, our quantity surveyors will assess whether an inspection is necessary for your investment property and expedite the process promptly.

Our property depreciation schedules are based on three crucial pillars:

- accounting experience

- construction industry knowledge

- detailed understanding of property related tax law

Frequently Asked Questions

-

Not understanding the importance and positive outcomes of a QS carrying out the report. Back to top

-

Worried your proceeding with a report that might not be worthwhile? Back to top

-

Information on the rental property too hard to get your hands on? Back to top

-

Why can’t a QS estimate renovation work if the costs are known? Back to top

-

Washington Brown seems too expensive compared to cheaper companies Back to top

-

My Rental Property is really old – how can there still be depreciation left to claim? Back to top

-

How far can you backdate your tax? Back to top

-

can you claim on renovations that previous owners have carried out? Back to top

-

Can you claim depreciation on an overseas property? Back to top

-

Why use a Quantity Surveyor to prepare my tax depreciation schedule and not an Accountant? Back to top

Get a quote for a property tax depreciation schedule on your rental property – or use our free property tax depreciation calculator to work out your potential cash flow tax saving.

Washington Brown’s fee is 100% Tax Deductible.