Capital gains tax (CGT) is a tax levied on the profit from selling an asset, such as an investment property. In Australia, the CGT is calculated based on the difference between the purchase cost and the sale price and is generally payable by the person who disposed of the asset. This blog post will discuss calculating CGT on an investment property in Australia.

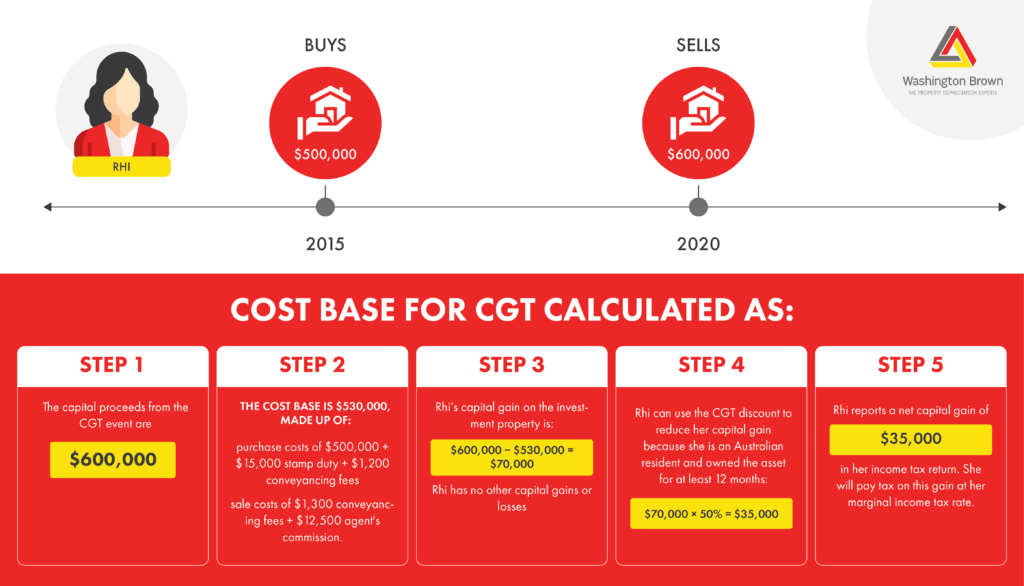

The first step in calculating CGT on an investment property is to determine the cost base of the property. The cost base is the total cost of the property, including the purchase price, stamp duty, legal fees, and other costs associated with acquiring the property.

It is essential to keep accurate records of these costs, as they will be used to calculate the CGT.

The next step is determining the capital gain or loss made on the sale of the property. This is done by subtracting the property’s cost base from the sale price.

If the sale price is greater than the cost base, a capital gain has been made, and if the sale price is less than the cost base, a capital loss has been made.

Once the capital gain or loss has been determined, applying the relevant CGT rate is necessary. The CGT rate in Australia varies for individuals.

However, there are some situations where a different rate may apply, such as if the property has been held for more than 12 months and is eligible for the CGT discount.

The next step is calculating the actual CGT amount by multiplying the capital gain or loss by the relevant CGT rate. If a capital gain has been made, the CGT amount will be added to the individual’s taxable income for the financial year in which the sale occurred.

If a capital loss has been made, the CGT amount can be offset against any capital gains made in the same financial year.

It is important to note that some exemptions and concessions are available for CGT on investment properties in Australia. For example, if the property was used as the individual’s primary residence for at least some time that they owned it, they may be eligible for the main residence exemption. This means that no CGT will be payable on the sale of the property.

Additionally, suppose an individual is over 55 years of age, and they sell their home. In that case, they may be eligible for the downsizing contributions measure, which allows them to contribute up to $300,000 of the proceeds from the sale of their home into their superannuation account.

Calculating CGT on an investment property in Australia involves determining the property’s cost base, determining the capital gain or loss made on the sale of the property, applying the relevant CGT rate, and calculating the actual CGT amount.

It is essential to keep accurate records of all costs associated with the property and to be aware of any exemptions and concessions that may apply. It’s always advisable to consult with a tax professional or accountant for a clearer understanding of your tax situation and to ensure you comply with the tax law.

I believe every year millions of dollars get paid in Capital Gains Tax that shouldn’t be, and here’s why:

When people renovate a property they are living in – they rarely keep records of they cost incurred on the upgrades that they make.

Then a baby might come along, a work opportunity overseas or any other reason that forces the property owner to turn that owner occupied property into an investment property.

Let’s move on 5 or 10 years… the owners decide to sell the property.

NOW because the property has been partially owner occupied and partially an investment – A Capital Gain Tax (CGT) implication has been triggered.

So off they go to their accountant – and the accountant asks “have you got any receipts of what work you did to the property??? Because that will REDUCE the CGT Payable“

You see any improvements the couple made to the property whilst living there, INCREASES the cost base of the property – thus lowering the amount you will need to pay in CGT.

We are increasingly being asked by accountants to go to a property to estimate the improvements made or in some cases the whole construction cost.

There are several ways to avoid paying capital gains tax when selling property in Australia, including:

- Living in the property as your primary residence: If you live in the property as your primary residence for at least six months of the year, you may be eligible for a full exemption on the capital gains tax.

- Using the property as an investment: If you rent out the property, you can claim deductions for expenses such as repairs, property management fees, and interest on the mortgage. These deductions can offset the capital gains, reducing the tax you have to pay.

- Using the property in a business: If you use the property in a business, such as a bed and breakfast or a farm, you may be eligible for a reduced rate of capital gains tax.

- Using the downsizer contribution: If you are over the age of 65 and sell your home, you may be eligible to make a downsizer contribution of up to $300,000 from the proceeds of the sale into your superannuation.

It’s important to consult a financial advisor or tax professional to determine which strategy is best for you.