Washington Brown – Sydney Office

At Washington Brown Quantity Surveyors – Sydney, we’ve provided depreciation schedules and quantity surveying advice to individual property investors and developers in Sydney for over 40 years.

We have experience across all building types – residential, commercial, industrial and government. We service all Sydney suburbs and regional and country NSW, including Newcastle, Wollongong, Blue Mountains, Central Coast, Coffs Harbour, Orange and Batemans Bay.

Our team of Sydney Quantity Surveyors, who are members of the Australian Institute of Quantity Surveyors, specialize in tax depreciation schedules.

Contact your local Sydney office today and let us help you pay less tax.

Request A Depreciation Quote Call 1300 990 612

How will a depreciation report help me?

Property investors are entitled to claim the wear and tear of an investment property against their taxable income.

The property’s age will affect how much you can claim. Newer properties tend to have higher depreciation claims since the Australian Taxation Office no longer allows depreciation claims on Plant & Equipment in second-hand properties. The best way to get expert guidance on your Sydney depreciation schedules claim is by requesting a quote here:

Don't Miss Out- Get a Free Depreciation Quote Now

How much will my depreciation report cost?

Many factors help determine how much a depreciation schedule will cost for your Sydney investment property.

Some of the factors include:

- Does the property need an inspection? Click on the link to learn about the property depreciation law changes regarding inspections. The laws have recently changed, and not all properties now need an inspection.

- Is your property commercial or residential?

- The locality of the property can affect the price of the depreciation schedule.

- The size of the property can affect the quote as well. The larger the property, the more rooms need to be measured, which can affect the price.

Why choose Washington Brown to prepare my Sydney Depreciation Schedule?

- We have over 300+ Google Reviews, with an average rating of 4.9 out of 5.

- Your Investment Property Magazine has rated us as the best Quantity Surveyor

- Our CEO is currently a Fellow of the Australian Institute of Quantity Surveyors.

- We have produced over 225,000 reports over the years and have never had a report disallowed by the Australia Taxation Office.

- We have been in business for over 40 years.

If you need a depreciation schedule for your Sydney investment property – get a quote here.

What does a Sydney depreciation schedule look like?

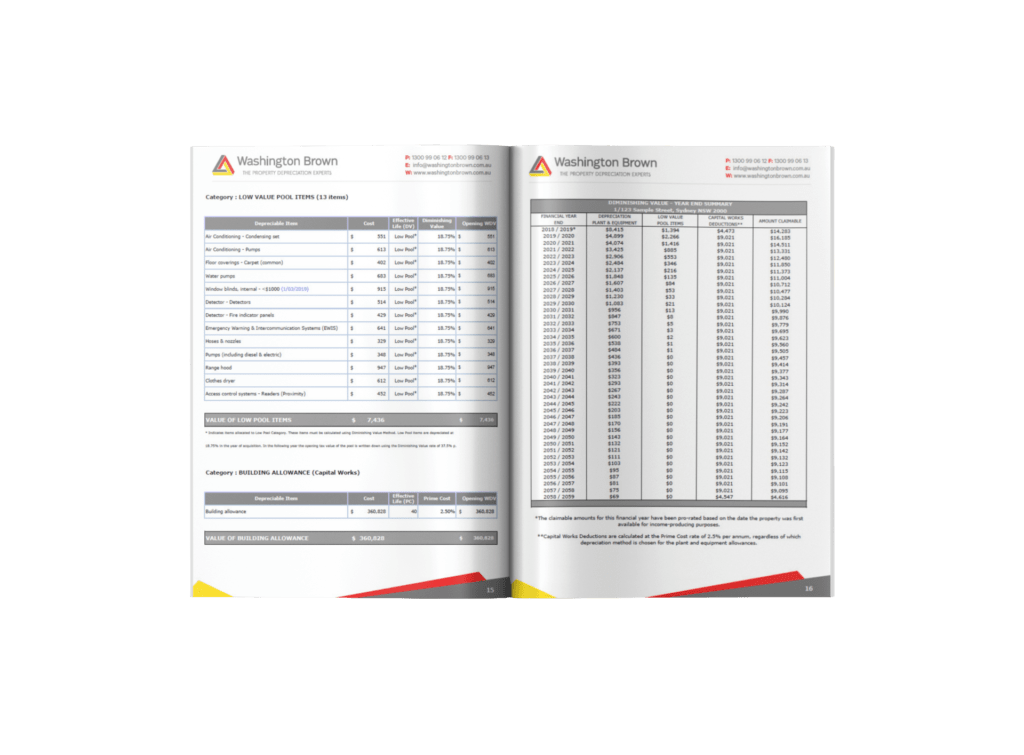

A Sydney tax depreciation report has two components: you can claim two types of allowances when depreciating a property.

First, you can depreciate the structure of the building, which is called the Division 43 allowance. This allowance relates to items such as bricks, concrete, etc.

The second part of a depreciation schedule relates to the Plant & Equipment in the building. These items pertain to fixtures such as ovens, dishwashers, and blinds. These objects are easily removable and depreciate faster.

How much depreciation can I claim on my Sydney property?

Your claim will depend on the type of property you have bought and how old it is.

The best way to calculate how much you can claim is to use the Property Depreciation Calculator.

Property Depreciation Calculator

Find out the potential return on a property

We used the calculator and found that you could claim over $100,000 over the first ten years, based upon a purchase price of $800,000.

How long will my depreciation schedule last?

The report generally lasts for 40 years when you order a depreciation schedule. Y

You do not need to return and request a new depreciation schedule because the information we provide will detail the allowance you can claim over the property’s lifespan.

How long will it take to get the depreciation report?

In individual circumstances, the report generally takes between one and two weeks to organise. The main factor that decides how long it takes is whether an inspection is required.

Because of recent law changes, not all properties need a property depreciation inspection.

What’s the difference between a depreciation schedule and a depreciation report?

Nothing. they’re just industry terms; sometimes, we refer to these reports as depreciation schedules and sometimes as depreciation reports.

What are capital works deductions?

Capital works deductions relate to the structure of the building, including brickwork, roofing, concrete, etc.

You claim the capital works allowance at 2.5% per annum based upon the original construction cost. So if the property initially cost $100,000 to build, you can claim $2500 per annum as a tax deduction.

The year the property was built impacts your depreciation claim, as the 40-year life of a capital works allowance will start from.

The capital works allowance can vary from 2.5% to 4% – but in most cases, as a residential property investor, you will only be claiming 2.5% .

Will you need to inspect my Sydney property to prepare a depreciation schedule?

That depends on the property. Because of recent tax law changes regarding depreciation laws for investment properties, an inspection may not always be necessary.

A qualified Quantity Surveyor should review your property first and then advise whether a property inspection is necessary to achieve the maximum depreciation allowances.

Can you prepare commercial depreciation reports?

Washington Brown also prepares office, industrial, and shopping centre depreciation schedules.

As a tenant, you can still benefit from a commercial property depreciation schedule if you’ve paid for the fit-out, allowing you to claim depreciation.

Can’t my accountant prepare my depreciation report?

The Australian Taxation Office clearly states that an accountant cannot estimate the construction costs where the costs are unknown.

Tax Ruling TR 97/25 identifies professional Quantity Surveyors as having the appropriate skillset to estimate the construction costs where the costs are unknown.

How often do I need to get a report?

The good news is that you only need to order a Sydney depreciation schedule once. The depreciation schedule will last for 40 years. Of course, if you make significant improvements to the property, it might be best to get the report amended and update your tax return.

If not, you can use the report for the life of the property, subject to your circumstances.

Are our fees tax deductible?

Yes, all fees paid for the depreciation schedule’s preparation are tax-deductible.

Do you offer a guarantee?

Yes, if we’re not able to achieve at least double your fee within the initial 12 months after your settlement date, there will be no charge.

So you have nothing to lose, and it’s highly recommended all property investors investigate getting a depreciation schedule.

Sydney Office Contact:

Tel: (02) 8324 7440.

Email: info@washingtonbrown.com.au

Address:

Suite 504, Level 5

321 Pitt Street

Sydney NSW 2000

Australia

Sydney Office Opening Hours:

Monday to Friday: 8:00am – 7:00pm