Why every property investor in Brisbane needs a depreciation schedule

Whether you’re a property investor or a property developer, Washington Brown can help you with your quantity surveying needs. We’ve experienced all building types – residential, commercial and industrial. We provide Brisbane depreciation schedules as well as its suburbs, Greater Brisbane Area, Gold Coast and the Sunshine Coast.

Our team of Brisbane quantity surveyors are members of the Australian Institute of Quantity Surveyors and are experts in tax depreciation reports and tax depreciation assets.

For over 40 years, we’ve been providing tax depreciation advice to our clients. We are experts in tax depreciation and will ensure you maximise the tax deductions on your investment property.

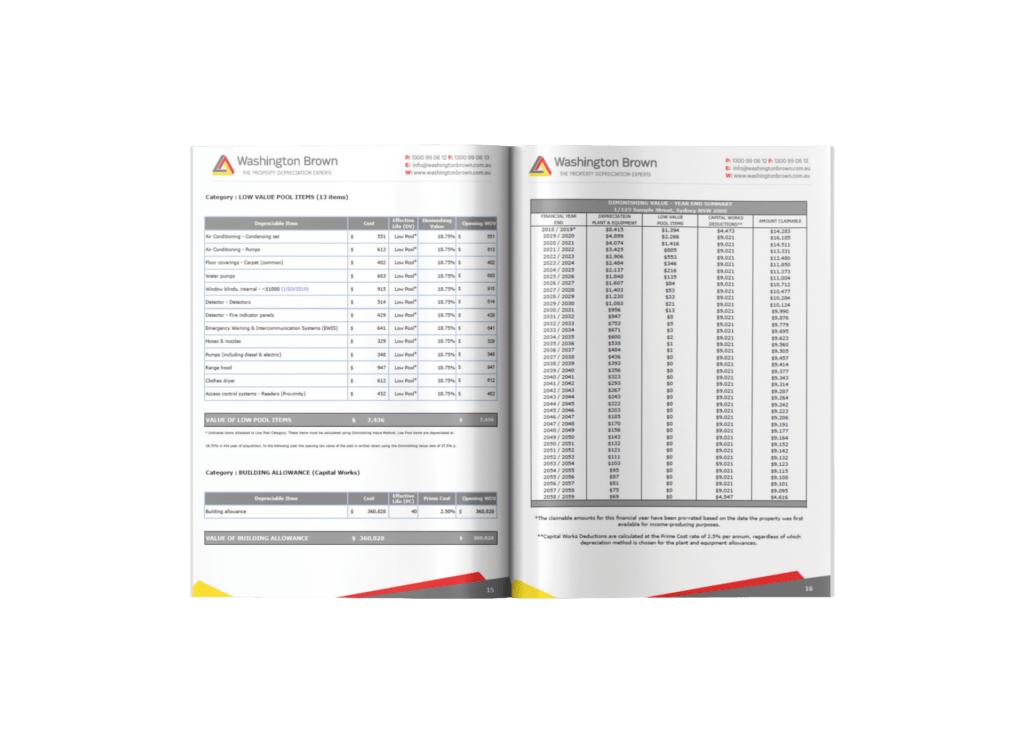

What does a Brisbane Depreciation Schedule look like?

Things to look out for in an adequately prepared depreciation report

- A Brisbane depreciation schedule should provide you with both the prime cost and diminishing value methods

- The report should last 40 years, so you can use it for longevity in your tax returns.

- The Quantity Surveying firm should be registered with the Australian Institute of Quantity Surveyors and be members of the Tax Practitioners Board.

- The report should be based upon your settlement date – not a generic calculation to July 1 for every year.

- The Quantity Surveyor should have advised first whether an inspection is needed or not. Not every property now requires an inspection since the laws have changed.

- Our team of Quantity Surveyors have been in business for over 40 years.

Can’t my accountant prepare this Brisbane depreciation schedule?

Where the costs are unknown, accountants, property managers or valuers can’t prepare tax depreciation schedules.

Tax Ruling TR 97/25 has identified Quantity Surveyors as appropriately qualified to estimate the construction costs and plant and equipment assets where the prices are unknown.

Your accountant, property manager, nor valuer can estimate these costs now. For expert guidance on how you can maximise your tax claims on your Brisbane investment property request a quote.

Request a Free Quote For Your Depreciation Schedule

How much will I pay for a Brisbane depreciation report?

That depends on several factors, mainly whether the investment property needs to be inspected or not.

Other factors include the size of the property, whether you have substantially renovated the property and have detailed costs to provide us, and whether the property is commercial or residential will also affect the price.

Commercial properties tend to be more expensive.

How much will I save by ordering a depreciation schedule?

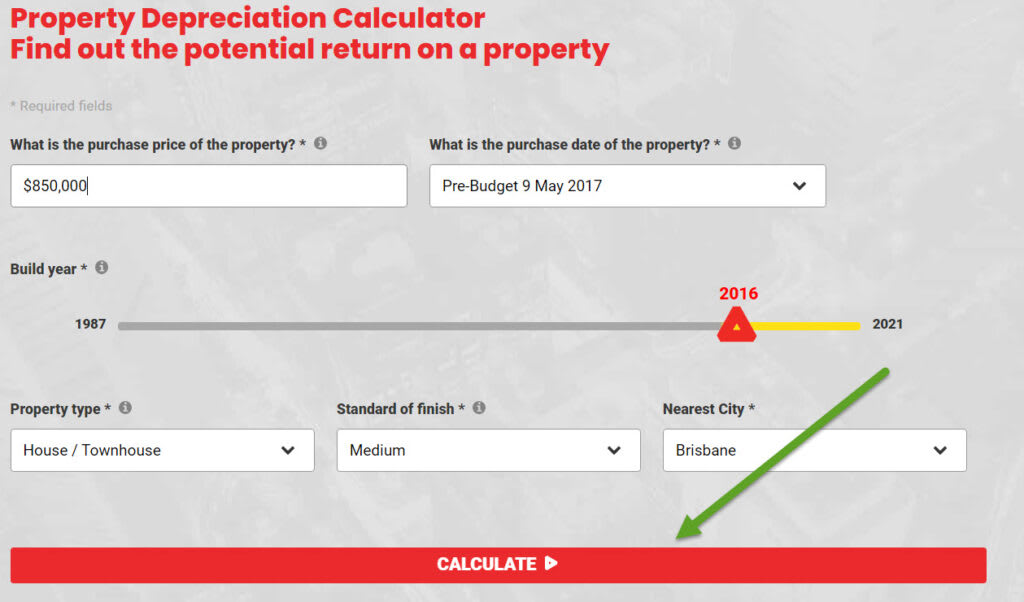

The best way to calculate how much you can save is by using the property tax depreciation calculator. Straightforward and easy to use and this is the only calculator on the market that enables you to receive a depreciation estimate simply by inputting a purchase price.

Property Depreciation Calculator

Find out the potential return on a property

You need to input the following variables into the calculator:

- The Purchase price

- What type of phave youyou have purchased

- When you purchased it

- The age of the property

- The location of the property (in this case, Brisbane)

Then press calculate as shown in the image below

Once you have pressed calculate, you should be able to receive an estimate of how much you can now claim in depreciation deductions on your Brisbane property.

Do I need to order a depreciation schedule every year?

No, once you have ordered the report – it will last you for the life of your property. If you make any changes to the property, you can give those costs to your accountant, who will assist you.

How do I start the ball rolling on my property depreciation report?

The best way to get the ball rolling is to receive a depreciation schedule quote for your Brisbane investment property.

We will then contact you; if we have any queries, email you the pricing.

To discuss your specific property, call us now on 07 3041 4151.

or snail mail: Level 38, 71 Eagle Street, Brisbane QLD 4000

Washington Brown Brisbane has been servicing the Brisbane region for over 40 years now – it’s the experience that counts! Trust Washington Brown with your investment property.