Can you claim depreciation on the previous owners’ renovations?

Yes, for investment properties, it doesn’t matter who paid for the renovations – as long as the work took place post-1987, you (as the new owner) are entitled to depreciate them. And the good news is even minor renovations can yield a significant amount of depreciation entitlements.

Let’s say you buy an income producing property that was renovated 20 years ago. The owners at the time spent about $100,000 putting in a new kitchen and bathroom. As the current owner, you would be looking at about $2500 worth of tax deductions each year for the next 20 years.

In most cases, the new owner won’t have access to the original renovation costs. But that’s where we come in.

Washington Brown has a team of trained tax depreciation quantity surveyors who can inspect the property, where necessary, and estimate the price of the renovations.

We then create a depreciation report that you can send straight to your accountant.

So there you have it. There are tax incentives for home renovations, as long it was renovated after July 1985, and these days most investment properties have had some level of upgrade, so it pays to find out.

Act quickly to get your complimentary depreciation quote

If I buy an older property and renovate it – Are the renovation costs tax-deductible?

If you renovate your investment property, the costs will be eligible for depreciation deductions. However, if you buy a rental property, don’t assume you can renovate it and claim an immediate tax deduction for the total cost of the work.

While you can get a deduction for repairs and maintenance, the ATO cracks down hard on investors who renovate but try to pretend that it’s just maintenance. Many new property investors believe that it should all be classified as repairs when they buy an old property that needs fixing. This is not the case. You must claim renovations on tax in a legal way.

What is the bathroom depreciation renovation rate?

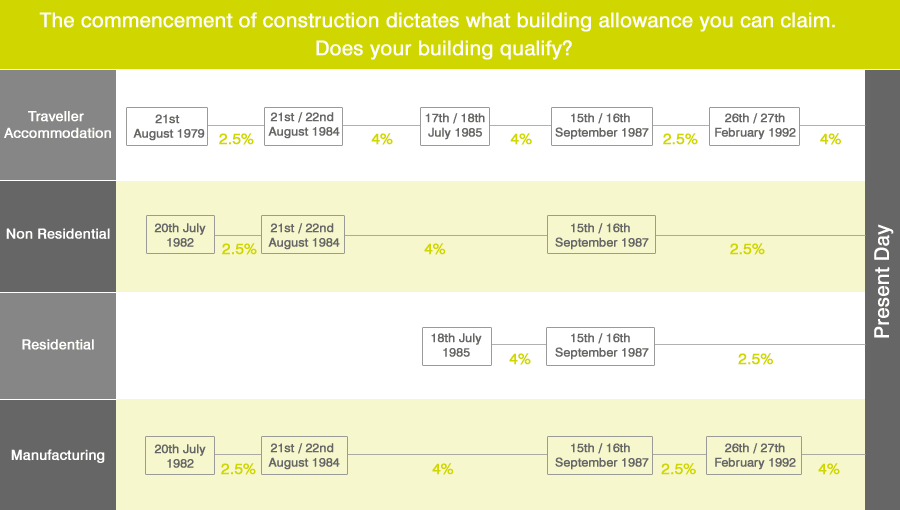

Bathroom renovations are considered Capital Works deductions, Division 43, and generally depreciate at 2.5 per cent per annum.

Some items will depreciate faster, such as light fitting and the exhaust fan, as they are considered Plant & Equipment items, also known as Division 40. The plant and equipment depreciation rate varies based on the asset’s effective life.

Can I claim renovation depreciation myself?

Certainly not if you have bought the property renovated. You will need to estimate the renovation costs from a qualified Quantity Surveyor.

The ATO accepts an estimate from a Quantity Surveyor where the costs are unknown.

However, If the renovations you have carried out are not too exhaustive, you can give the costs to your accountant. You can also use our depreciation calculator for an accurate estimate on the likely tax depreciation deduction on your investment property.

Property Depreciation Calculator

Find out the potential return on a property

Can I claim renovation depreciation from the previous owner?

Yes, you can claim rental property depreciation on the previous owner’s work. However, you can only claim the depreciation on the capital works allowance, not the plant and equipment, as they would be defined as ‘previously used’ assets.

What is the office renovation depreciation rate?

The office depreciation rate is the same as the residential renovation depreciation rate. You can claim both at 2.5% per annum based upon the original construction costs or building works over 40 years.

Do you need a quote for a depreciation schedule this financial year?