Top * changes to property depreciation laws

Under the new Depreciation Tax Law Changes, property investors who acquire a second-hand residential property on or after 10 May 2017 that contains “previously used” assets will no longer be able to claim depreciation on those eligible assets. In this case, existing assets include ovens, dishwashers or blinds.

The Government successfully voted on new legislation to change how depreciation works, representing the most significant move in the industry that I’ve ever seen – and I’ve been a qualified quantity surveyor for over 25 years.

The budget changes were effective as of 9 May 2017 at 7.30 pm, when the Federal Budget was handed down. As you can imagine, they have enormous implications for property investors and, more importantly, the property equation, which we’ll go into later.

So, what are the new depreciation law changes exactly?

The best way to understand it is to break the changes down into Ten simple vital points:

1. You can no longer claim depreciation on “previously used” plant and equipment

Acquire a second-hand residential property from 10 May 2017, which contains ‘previously used’ depreciating assets. According to the ATO, you will no longer claim depreciation deductions on those assets. This refers to the plant and equipment portion of a depreciation schedule. Those items with a lower effective life, include;

• Ovens

• Dishwashers

• Lights

• Air-conditioners

• Televisions

• Carpets

• Lounge suites

• Blinds

• Common property plant and equipment items.

2. You can still claim the capital works deduction

However, the building allowance tax deduction, or claims on the structure of the building, has not changed at all.

You will still need a depreciation schedule to calculate these deductions. This typically accounts for 85 per cent of the overall construction cost. The structure includes items like brickwork and concrete, so that’s no change.

Get started with your FREE depreciation quote now

3. There are no changes if the property is brand new

Acquirers of a brand new property will claim depreciation deductions in the same way as they have done to date – for both plant and equipment and structure. This is excellent news for the property industry because many developers rely on depreciation as part of their marketing strategy to attract investors.

The Government resisted changing depreciation on the new property because it did not want to halt construction, which would have impacted the supply of new property. A downturn in the construction industry would also have a knock-on effect – if tradies are out of work, they aren’t paying tax.

4. Do you still need to inspect the property now that the laws have changed?

Not all properties need to be inspected moving forward. We may have the cost already on our database, or you may already have the costs of the assets.

Some firms still say every property needs to be inspected – but that is not true.

Learn more about property depreciation inspections and why not all properties now need an inspection.

5. What happens if I renovate a property then sell it?

If you renovate a house while living in it, and then sell the property to an investor, the plant and equipment assets will be deemed previously used, and the new owner will not be able to claim the renovations on their tax returns.

However, the new owner will still be able to claim deductions on the structural portion of the renovation.

6. How do the new depreciation law changes affect different entities?

The federal budget changes to depreciation tax laws do not apply if you buy the property in a corporate tax entity, a super fund (note that self-managed super funds do not apply here) or a large unit trust. In other words, you can still buy a second-hand property in a company name and claim depreciation.

You can buy a second-hand property in a super fund – as long as it’s a large one – and a large trust can buy a property as long as it has 300 members

or more, and claim depreciation on that property.

7. How do the depreciation law changes work regarding commercial property?

The changes only relate to residential property. Commercial, industrial, retail and other non-residential properties are not affected, so you can still buy a second-hand office or similar and continue to claim the second-hand carpet, precisely as you could before. As I’ve explained above, you can’t do this for residential property.

8. If I build a brand new investment property, how will the change in depreciation law work?

If you engage a builder to build a brand-new house or do the work yourself and it remains an investment property, you will still be able to claim depreciation on both the structure and the plant and equipment items.

This is because it’s brand new and was brand new when you installed that oven. Therefore, you can still claim it because the asset’s cost is known.

9. How do the new depreciation laws work if I already own an investment property?

The good news is that the new legislation is ‘grandfathered’. That means that for everyone with an existing rental property depreciation schedule, you can continue to claim precisely as you have been doing.

So, nothing has changed if you bought a property before the budget – 9 May 2017. And if you have purchased an investment before this date and don’t have a depreciation schedule, there’s never been a better time to get one! You might not get these allowances again.

One final point on grandfathering; if you bought a property before the budget and it is owner-occupied, and then you move out after 1 July 2017 financial year – you will not be able to claim depreciation on the plant and equipment in that property.

Those items will be deemed previously used and caught in the net of the changing legislation – even though you acquired the property before the Budget 2017 depreciation changes. So, these changes are kind of ‘half grandfathered’.

How much will these changes mean in terms of how much depreciation I will be able to claim moving forward?

Well, to understand this – it’s best to examine three different scenarios:

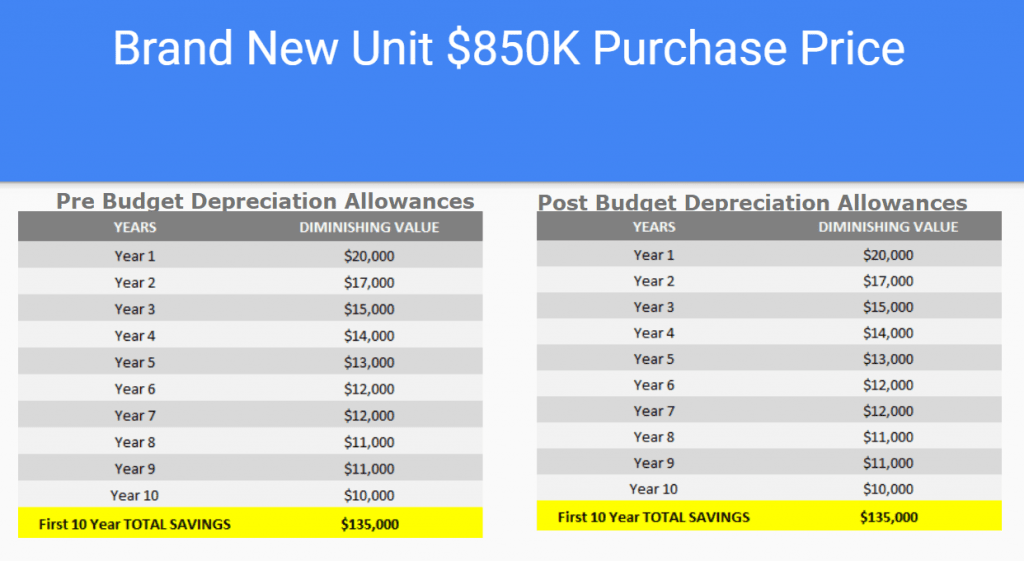

Scenario 1:

An investor buys a brand new unit or house for $850,000.

As you can see from the above chart, the depreciation amount you can claim if you bought the same property pre-budget or post-budget hasn’t changed.

That’s because a brand new property is exempt from these changes.

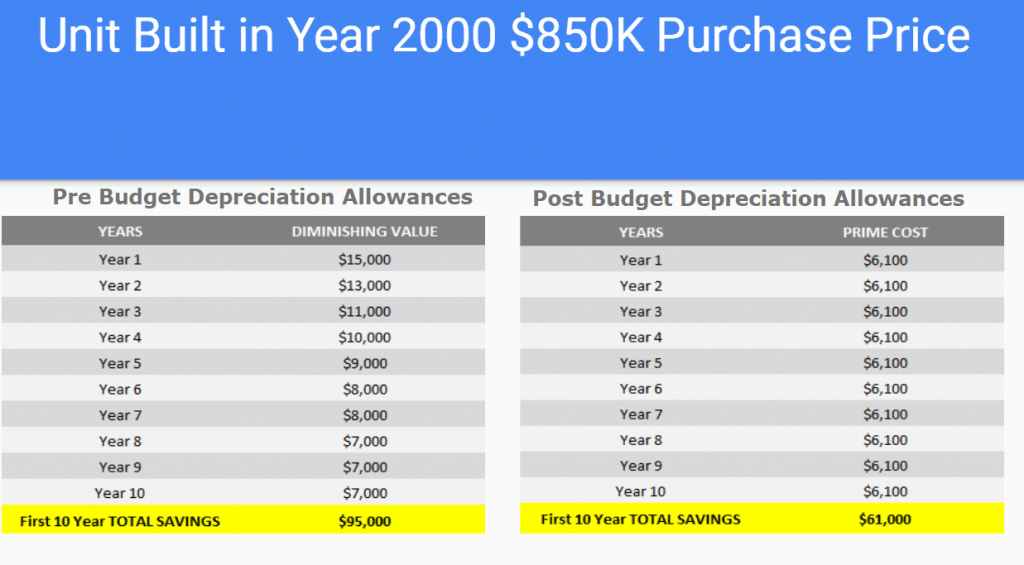

Scenario 2:

An investor buys a residential house or unit for $850,000 built in 2000.

As you can see from the above, the available depreciation allowances have dramatically reduced in the early years.

Towards year 8, they level out and aren’t that different. This is because the pre-budget chart on the left-hand side still shows that you can claim the plant and equipment. The chart on the right-hand side shows how you can only claim the building allowance moving forward.

The key takeaway is that the depreciation allowances on a second-hand property built after 1987 are affected most in the first five years. After that – there’s not much difference.

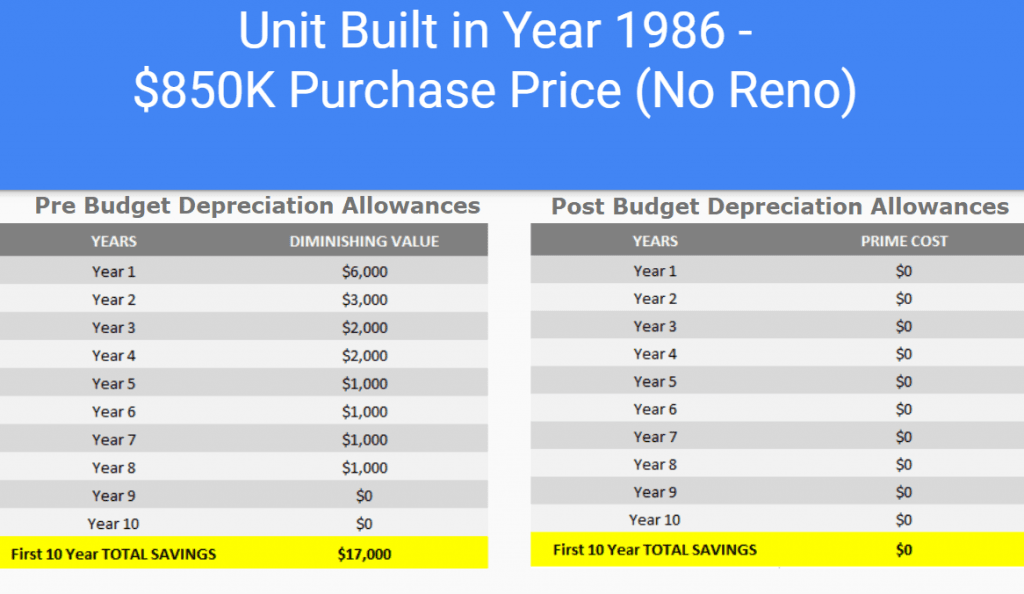

Scenario 3:

An investor buys a residential house or unit for $850,000 built before 1987 – that hasn’t been renovated.

My final thoughts on the new depreciation rules apply

I agree that the constant revaluing of plant & equipment items on very old properties made no sense and needed refinement.

However, I think the Government’s approach to disallowing depreciation on properties that are near new doesn’t make much sense and could’ve been rolled out far more logically.

What will my potential savings look like?

Your total amount claimable with a depreciation schedule varies depending on factors such as the property’s value, age, and type of assets involved. However, to view an estimate you can use our depreciation schedule calculator.